Why Residential Property Still Wins for Long-Term Growth

Every investor faces the same question. Where does real long-term growth come from? Some turn to shares. Others chase the next big trend.

Yet through every boom, correction, and policy change, residential property has quietly proven its strength in the Australian market.

The real challenge is not deciding if property works but understanding why it keeps outperforming when other assets lose momentum.

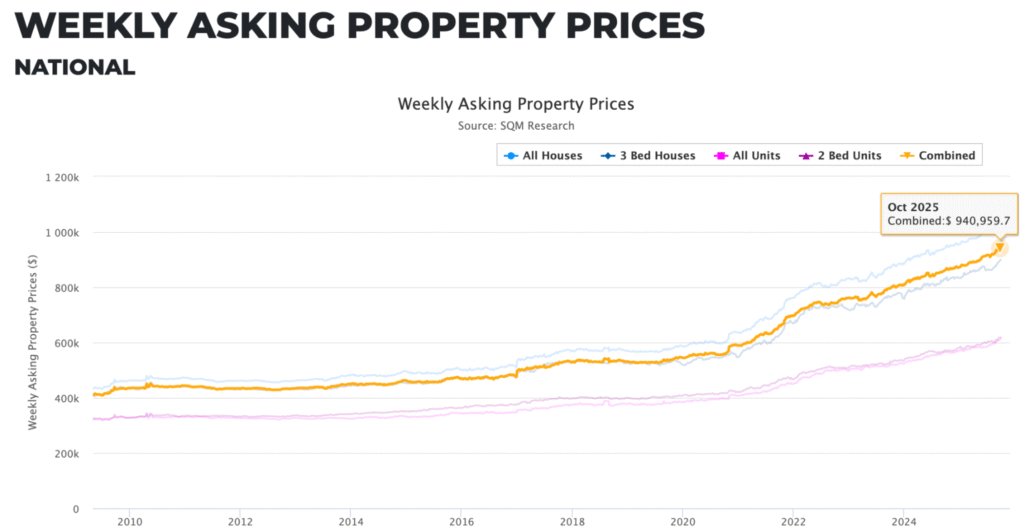

As you can see from the chart below by SQM research, the asking prices of combined houses in Australia has more than doubled over the last 16 years.

Source: SQM Research

Many investors focus on short-term wins or fear affordability pressures and rising rates, forgetting that property rewards patience, structure, and timing.

This article explores the factors that make residential property investment in Australia a reliable path to long-term property growth.

We will decode the forces that keep property ahead and help readers see why it continues to shape financial freedom for Australians who invest with strategy and clarity.

What Drives Long-Term Growth in Property

Every successful long-term property investment in Australia begins with understanding what truly drives performance over time.

While market sentiment fluctuates and short-term results fluctuate, the real wealth in residential property comes from three enduring fundamentals: capital appreciation, reliable rental income, and the strategic use of leverage.

These pillars work together to create consistent residential property long-term growth and help investors build lasting financial security.

The Role of Capital Appreciation

Capital appreciation forms the foundation of long-term property growth in Australia. Over the past three decades, national housing values have risen steadily, with CoreLogic data showing that median house prices have increased more than fivefold in 30 years.

Even during economic downturns, residential property has demonstrated resilience because demand continues to outpace supply.

Key drivers of capital growth include:

- Population growth: Migration continues to rise, driving steady demand for housing.

- Urbanisation: More Australians are moving toward city centres and connected regional hubs.

- Infrastructure investment: Transport links, schools, and employment zones increase the appeal of specific locations.

- Land scarcity: Limited supply ensures continued upward pressure on prices.

This ongoing imbalance between supply and demand creates the steady capital growth rates that investors rely on.

Residential property long-term growth is therefore built on real economic activity, not speculation, giving investors confidence through every market cycle.

Rental Yield and Passive Income

Rental yield is the income engine that powers residential property investment in Australia. It provides consistent cash flow that supports mortgage repayments, funds maintenance, and creates financial flexibility during different market phases.

For investors seeking passive income property in Australia, a well-selected property can produce ongoing returns while steadily increasing in value.

What determines rental yield performance:

- Gross yield: Total rent collected before expenses.

- Net yield: Actual return after costs such as insurance, vacancies, maintenance, and management fees.

- Tenant demand: Areas with strong employment and infrastructure attract stable renters.

- Property quality: Well-maintained homes command higher rents and lower vacancy rates.

As rents rise over time, cash flow strengthens, improving holding power and freeing up capacity to reinvest. This balance between growth and income helps investors compound results year after year.

Leverage and the Compounding Effect

Leverage allows investors to scale wealth through financial investment property in Australia. By borrowing to purchase an asset, investors can control a higher-value property with a smaller upfront contribution. As the property appreciates, equity compounds on the full value, accelerating wealth creation.

How leverage and compounding work:

- Equity growth: Property appreciation builds value faster than the original deposit.

- Compounding: Gains each year grow on the entire property value, not just the deposit.

- Portfolio expansion: Growing equity can be used to finance additional investments.

- Risk control: Conservative loan-to-value ratios and liquidity buffers protect against downturns.

When managed responsibly, using mortgage leverage in property becomes one of the most effective strategies for achieving long-term residential property growth.

The compounding effect of reinvested equity transforms a single purchase into a sustainable wealth-building plan supported by data and structure.

The Edge Over Other Asset Classes

When investors compare property vs shares return comparison, the difference lies in control, consistency, and stability.

Residential property remains one of the few assets that can be physically improved, reliably held through cycles, and protected against inflation.

These advantages have made long-term property investment in Australia a proven path for building sustainable wealth.

Tangible and Controllable Asset

Residential property investment in Australia provides investors with a level of influence rarely found in other asset classes. Unlike paper-based investments, it allows for direct action that can enhance both value and income.

Ways property creates control and value:

- Renovation potential: Strategic improvements can lift value and attract quality tenants.

- Repositioning: Adjusting tenant type or property use can strengthen cash flow.

- Maintenance and presentation: Consistent upkeep protects capital value and demand.

Property is tangible and visible. Investors can assess its condition, oversee its management, and make informed decisions that shape long-term results.

This physical connection provides confidence and clarity, creating a stronger sense of security compared to more abstract investments.

Inflation Hedge

Inflation reduces purchasing power, yet property value appreciation in Australia has repeatedly outpaced it. As the cost of goods, labour, and construction rises, so too do housing prices and rental income. This relationship allows property to maintain real value while other assets erode over time.

Why does property perform well during inflation?

- Rising rents: Income naturally adjusts to higher living costs.

- Limited supply: Scarcity of land restricts the new housing supply.

- Real asset value: Physical assets retain worth despite currency movement.

Compared to fixed-income investments such as bonds or cash, residential property provides measurable protection. While savings lose value during inflationary cycles, well-located property continues to generate income and appreciate in real terms.

Tax Incentives and Structural Benefits

The structure of the Australian tax system strengthens residential property long-term growth by rewarding ownership and investment.

When managed strategically, these benefits improve overall returns and support portfolio expansion.

Key advantages include:

- Interest deductions: Mortgage interest on investment loans can be claimed as an expense.

- Depreciation: Building and fixture wear can be deducted annually.

- Maintenance and management costs: These reduce taxable income.

- Capital Gains Tax discount: A reduction applies when assets are held beyond 12 months.

- Negative gearing: Enables investors to offset losses against other income sources.

These tax deductions for property investment in Australia help balance short-term costs while improving after-tax performance.

Combined with steady capital growth and rental yield, they create a strong incentive for investors seeking long-term financial stability.

Lower Volatility and Stronger Holding Power

Unlike shares or other liquid investments, residential property long-term growth follows a more stable cycle.

Property owners are less likely to sell during downturns because the asset serves practical, long-term purposes such as housing and financial security.

Why property remains steady through market cycles:

- Essential demand: People always need housing, regardless of economic strengths.

- Lower emotional reaction: Property transactions take time, reducing impulsive decisions.

- Reliable income: Rental payments continue even during slower markets.

This natural holding power makes property resilient through uncertainty. Investors who focus on long-term property investment in Australia benefit from its steady growth, compounding equity, and dependable income streams.

Key Factors That Differentiate Winners from Losers

Success in long-term property investment in Australia depends on strategy and precision. While market movements affect everyone, the best investors consistently make smarter decisions about where, what, and when to buy.

The difference between outperforming and underperforming portfolios often comes down to four key factors: location, property type, economic tailwinds, and timing.

Location and Infrastructure

Location remains the single most important driver of residential property long-term growth. Properties situated close to quality infrastructure and lifestyle amenities tend to outperform over time.

Accessibility, convenience, and future urban development all influence both buyer and tenant demand.

High-performing locations often share these traits:

- Proximity to transport links such as train lines and arterial roads.

- Easy access to employment hubs, schools, and healthcare services.

- Vibrant local amenities including retail, dining, and recreation.

- Planned infrastructure projects that expand connectivity and livability.

New transport corridors and major precinct developments can reshape entire suburbs, creating new growth pockets. Investors who study government infrastructure pipelines and population data can position themselves ahead of the next wave of property value appreciation in Australia.

Property Type, Design, and Use Cases

The type of property determines both rental performance and long-term growth potential. Different asset classes within residential property investment in Australia attract different buyer and tenant profiles, making careful selection essential.

Key considerations when assessing property type:

- Houses: Offer stronger land value and appeal to families seeking space and stability.

- Units: Provide affordability and access to inner locations, but can be limited by strata restrictions.

- Townhouses: Balance affordability with lifestyle features and solid rental demand.

- Multi-unit and duplex models: Create opportunities for higher yields and future flexibility.

- Short-term or build-to-rent options: Deliver income potential but require professional management.

Design also matters. Functional layouts, natural light, and quality finishes improve rental appeal and resale performance. Properties that align with demographic preferences and local demand consistently outperform over time.

Economic and Demographic Tailwinds

Population and employment trends are powerful forces behind long-term property growth. Suburbs supported by strong local economies, growing industries, and population inflows are better positioned for sustained capital growth and rental demand.

Economic and demographic indicators to prioritise:

- Consistent job creation in diverse sectors such as health, education, and construction.

- High interstate and international migration boosting demand for housing.

- Government rezoning and urban renewal projects encouraging density and development.

- Expanding education and lifestyle precincts that attract young families and professionals.

When local incomes rise in step with property values, market fundamentals remain balanced. Identifying these tailwinds early allows investors to focus on markets with enduring residential capital growth rates and strong economic resilience.

Market Timing and Cycle Awareness

Even the best property can underperform if purchased at the wrong point in the cycle. Growth in residential property long-term investment is never linear, which makes cycle awareness crucial.

Timing decisions with objective data prevents emotional buying and ensures entry into markets with genuine upside.

Indicators to watch before entering a market:

- Vacancy rates: Declining figures signal rising tenant demand.

- Supply pipeline: Oversupply may limit price growth and rental returns.

- Interest rates: Lower borrowing costs often spark renewed buyer activity.

- Days on market: Shorter selling times indicate stronger conditions.

Markets move in stages of growth, balance, and correction. Successful investors track these and act with discipline rather than urgency.

Understanding market timing allows them to capture appreciation early and hold through the next cycle with confidence.

Risks, Pitfalls, and How to Mitigate Them

Every investment carries some degree of risk, and residential property investment in Australia is no exception. The difference between successful and struggling investors often comes down to how well those risks are understood and managed.

When handled proactively, these factors become manageable variables that protect both growth and cash flow over the long term.

Interest Rate Risks and Leverage Stress

Fluctuating interest rates can directly affect borrowing capacity, loan repayments, and portfolio performance. When rates rise, investors who rely heavily on debt may find their cash flow under pressure.

For anyone using leverage to finance property, maintaining a balance between opportunity and risk is essential.

Mitigating this begins with careful loan structuring. Holding a financial buffer that covers several months of repayments provides flexibility, while fixing part of a loan can add certainty during periods of volatility.

Prudent borrowing ensures that property portfolios continue to perform even as lending conditions change.

Vacancy, Tenant Turnover, and Property Management

Consistent rental income is one of the defining strengths of long-term property investment in Australia, but vacancies can interrupt that stability.

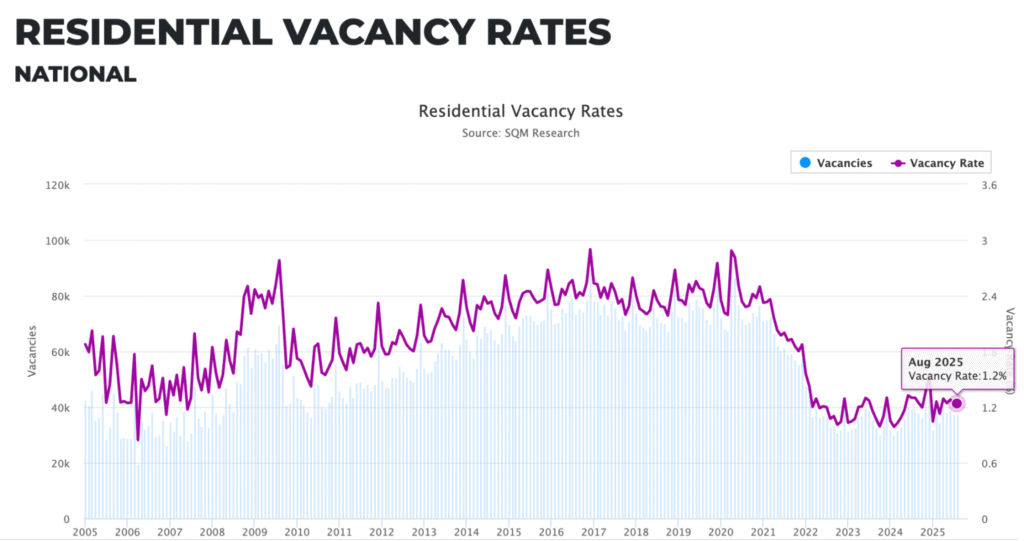

Periods without tenants reduce yield and can make it harder to cover ongoing expenses. Effective property management and strong local demand are the best defences.Australian property has consistently shown lower national average vacancy rates, depicted in the chart below from SQM research. The current national average vacancy rate was sitting at 1.2% as of August 2025.

Source: SQM Research

Selecting properties in high-demand areas near jobs, schools, and transport helps minimise downtime. A professional property manager can also screen tenants thoroughly, coordinate maintenance, and maintain communication that encourages long-term leases.

This structure supports a reliable income and ensures the property continues to generate steady rental returns.

Unexpected Capital Expenditures and Maintenance

Maintenance costs and sudden repairs are inevitable parts of property ownership. Structural issues, appliance replacements, or minor damages can erode profit margins when unplanned. Accounting for these costs upfront transforms them from surprises into manageable expenses.

Comprehensive building inspections before purchase can identify potential risks early. Regular maintenance preserves value, attracts quality tenants, and avoids expensive future repairs. Well-maintained properties achieve higher valuations and stronger capital growth over time.

Overcapitalising Vs. Undercapitalising Renovations

Renovations can create equity or waste capital depending on how they’re executed. Overcapitalising occurs when spending exceeds the property’s resale potential, while underinvesting can limit growth and tenant appeal. Finding the right balance is key to sustainable long-term property growth.

Investors who research comparable sales and understand local buyer preferences make smarter renovation choices. Improvements to high-impact areas such as kitchens, bathrooms, and outdoor living spaces typically yield the strongest returns.

Every upgrade should enhance market value and strengthen rental performance without compromising profitability.

Regulatory, Zoning, and Tax Changes

Policy adjustments can shape the performance of property investment in Australia. Changes in zoning regulations, lending frameworks, or tax laws, such as capital gains tax and negative gearing rules, can alter the financial landscape. Investors who remain informed are best positioned to adapt quickly.

Monitoring government announcements and seeking professional advice ensures decisions remain compliant and strategic.

Structuring ownership through the right entities and maintaining diversified holdings also helps reduce exposure to sudden regulatory swings. Staying informed safeguards portfolio stability and strengthens long-term growth.

Liquidity and Transaction Costs

Unlike liquid investments such as shares, property requires time to buy or sell. High entry and exit costs, including stamp duty, agent commissions, and settlement fees, mean timing matters. Investors who prepare for this reality can manage liquidity risk effectively.

Keeping an accessible cash or equity buffer provides flexibility during life events or market changes. Long-term planning around exits, refinancing, and portfolio balancing also prevents rushed decisions.

A disciplined approach allows investors to hold quality assets through market fluctuations while still having access to funds when needed.

How to Analyse and Select a Property for Long-Term Growth

Choosing the right property is a process that rewards structure and discipline. Each step builds on the last, creating a framework for confident decision-making and sustainable performance.

When followed carefully, this process turns property investing into a long-term strategy guided by clarity, data, and foresight.

1. Financial Modelling and Forecasting

Every strong investment begins with accurate financial analysis. Before committing to a purchase, investors should model income, expenses, and financing to understand how the property performs across different scenarios.

This involves projecting rental income, calculating loan repayments, and allowing for maintenance, vacancies, and tax considerations.

A reliable financial model reveals whether the property can sustain itself while generating consistent returns.

It helps define borrowing limits, evaluate repayment structures, and highlight potential risks early. This groundwork ensures that each purchase contributes to a stable, scalable portfolio.

2. Comparable Sales and Rental Benchmarking

Once the financials align, the next step is confirming the property’s true market value. Reviewing recent sales of similar homes, active rental listings, and long-term yield trends provides context for both purchase price and expected performance. These comparisons validate assumptions and ensure the asset sits within its local market range.

Benchmarking also highlights whether growth is supported by consistent demand or temporary market activity. Evaluating multiple data sources, including valuation reports and suburb profiles, strengthens decision-making.

This process helps investors identify opportunities that deliver genuine value and predictable returns.

3. Due Diligence and Legal Checks

Due diligence protects investors from unforeseen issues that can undermine long-term results. Each property should undergo thorough inspections and legal verification before settlement.

Building and pest reports assess the physical condition, while title and zoning searches confirm ownership rights and future development potential.

Legal due diligence also ensures compliance with local regulations and identifies any restrictions that may affect renovations or resale.

Addressing these details before finalising a contract prevents costly mistakes. A disciplined due diligence process supports confidence and preserves both value and flexibility.

4. Market and Suburb Research

Understanding the broader market landscape is essential for long-term growth. Investors should focus on suburbs supported by strong employment, lifestyle infrastructure, and population growth.

Areas with low vacancy rates, limited land supply, and access to transport tend to attract stable rental demand and steady appreciation.

Analysing demographic trends and future infrastructure projects provides a clear view of demand sustainability. Monitoring development pipelines and housing approvals helps determine where supply may expand or tighten.

Markets grounded in genuine fundamentals are more resilient and perform consistently through economic cycles.

5. Exit Strategy and Holding Period

Every property should be purchased with a clear plan for when and how to realise returns. Whether the goal is to hold for income, refinance to access equity, or sell after achieving capital growth, defined objectives shape financial structure and management decisions. A clear exit plan reduces uncertainty and strengthens long-term direction.

Regular portfolio reviews ensure that each asset continues to align with broader financial goals. Adjusting loan structures, assessing performance, and rebalancing holdings over time maintain portfolio efficiency.

With a strategic exit plan in place, investors manage their properties with intent, discipline, and purpose.

Getting Started with Long-Term Property Investment

Building a property portfolio begins with clarity and preparation. Many aspiring investors understand the benefits of real estate but hesitate when it comes to taking the first step.

Establishing a roadmap early creates direction and reduces uncertainty, turning ambition into practical action.

How Much You Need to Start

The entry point for property investment depends on deposit size, borrowing capacity, and location.

Most lenders require between 10 and 20% of the property’s value as a deposit, though some government or lender programs may reduce this threshold. Additional costs such as stamp duty, legal fees, and inspections should also be budgeted for.

The goal is to start with a realistic plan rather than wait for the perfect time. Even a modest purchase can deliver long-term results when guided by data and structure.

Planning around total purchase costs rather than just the deposit helps avoid financial surprises once the process begins.

Funding and Financing Options

Finance is one of the most powerful levers in building wealth through property. Understanding the range of available options allows investors to use lending strategically while maintaining stability.

These options include traditional bank loans, mortgage brokers who compare products across lenders, and government initiatives designed to support first-time buyers.

Before choosing a structure, investors should assess loan features such as offsets, redraw facilities, and fixed or variable terms.

Regularly reviewing borrowing arrangements as equity grows can also unlock new expansion opportunities. With careful planning, finance becomes a tool for controlled leverage and steady growth.

Working with Professionals

Property investment is a team effort. Engaging specialists creates efficiency, reduces risk, and ensures decisions are backed by expertise.

Key professionals include buyer’s agents who source quality assets, finance brokers who structure loans, property managers who maintain income flow, and accountants who optimise tax outcomes.

Building a network of trusted advisers helps investors stay focused on strategy rather than logistics. Each professional plays a distinct role in supporting both acquisition and long-term management.

The collective knowledge of this team enhances decision quality and ensures compliance with ever-changing market and lending conditions.

Actionable Steps to Begin

Starting the investment journey requires structure and momentum. A few focused actions can transform planning into progress:

- Define clear goals for income, growth, and lifestyle outcomes.

- Review borrowing capacity and confirm financial buffers.

- Research growth markets with strong demand and limited supply.

- Engage a qualified property team to guide acquisition and management.

- Secure pre-approval to move quickly when the right opportunity appears.

Following these initial steps gives investors confidence and a clear pathway forward. Every well-built portfolio begins with consistent, informed action.

The Next Move Is Yours

Property remains one of the few investments that rewards patience, structure, and clarity. It compounds quietly through changing markets, builds stability through income, and continues to create wealth when other assets lose pace.

When guided by data and strategy, residential property becomes a vehicle for freedom and long-term financial strength.

Every idea in this guide leads to a single truth: consistent success comes from focus and execution.

The investors who thrive are the ones who understand the fundamentals, choose quality assets, and stay disciplined when others react to noise. Growth is built on clear decisions, not chance.

Now is the moment to move forward. Define your goals, review your borrowing power, and take action with confidence.

If you are ready to invest with purpose and precision, book your strategy session with our team today. The results you want begin with the steps you take next.