Investors: Think You Need a 20% Deposit? Think Again.

Most Australians never make it past the first step of property investing. They think the gate is locked until they’ve saved a 20% deposit. It sounds safe. It feels responsible. But it’s costing them years.

While they wait for a perfect number, prices climb, rents rise, and opportunity drifts further out of reach. The market doesn’t pause for anyone.

The truth is, the 20% rule was built for another time. Today’s investors are finding faster, smarter ways in. They’re using data, strategy, and leverage to buy sooner without taking on reckless risk.

We’ll break down how much deposit you really need to invest in property in Australia, what’s changed in 2025, and how to turn knowledge into action before the next growth wave leaves you behind.

Why the 20% Deposit Rule Is Holding Investors Back

The 20% deposit rule has been repeated for decades as if it were a financial commandment. Many Australians still believe they must hit that number before investing, even when the data tells a different story. This belief has quietly stopped more investors than it has ever helped.

That rule began in a time when banks feared risk more than they valued opportunity. The deposit you pay upfront shows commitment, while the rest is borrowed as a loan measured through a loan-to-value ratio (LVR).

For years, an 80% LVR was seen as the safe limit, creating a comfort zone for lenders and a roadblock for everyday investors.

According to ASIC’s MoneySmart, a lender’s mortgage insurance applies once borrowing exceeds 80% of a property’s value.

This policy was designed to protect banks from loss, not to protect investors from missing opportunities. The result is that many Australians have waited for a target that was never truly required.

Modern lending operates differently. Data, technology, and competition now shape how banks assess borrowers.

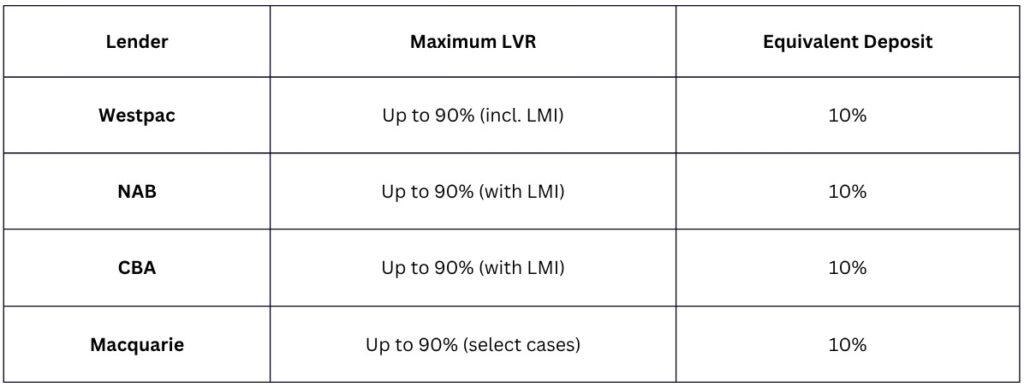

Westpac’s 2025 policy allows investment loans up to 90% LVR with LMI, showing how lenders reward strong financial profiles rather than punishing smaller deposits.

Lenders today look beyond savings alone. Income stability, credit strength, and strategy now matter more than a single percentage on paper.

Investors who understand this can enter sooner, grow faster, and build momentum instead of waiting for a perfect savings figure.

Kev Tran Group’s data and client results confirm this. We have seen investors begin with smaller deposits and outperform those who spent years saving for 20%.

The old rule belonged to a slower era of finance. In today’s market, it has become a reason why too many Australians delay building wealth.

How Much Deposit Do You Really Need in 2025

The idea that investors need a 20% deposit before buying property has become one of the biggest myths in Australian real estate. It keeps capable buyers saving for years, while others use smarter structures to enter the market sooner.

The truth is, the lending environment no longer rewards those who wait; it rewards those who plan.

Major banks now recognise that a smaller deposit does not always mean greater risk when the right foundations are in place.

Westpac, NAB, CBA, and Macquarie all approve investment loans with deposits as low as 10% when lender’s mortgage insurance (LMI) is included.

These policies focus on the strength of an investor’s income, repayment history, and overall financial strategy rather than an outdated savings benchmark.

According to the Australian Prudential Regulation Authority, 30.4% of all new loans in June 2025 were written with an LVR above 80%, showing that thousands of Australians are already buying with less than a 20% deposit.

These investors are not reckless; they are strategic. They understand that waiting to save an extra 10% could cost them years of capital growth and higher entry prices.

Kev Tran Group’s experience confirms this trend across the property market. Many investors we work with begin with smaller deposits and outperform those who wait for the traditional threshold.

They use equity, structure, and timing to compound results faster and position themselves for long-term wealth.

The evidence is clear. In 2025, the smartest investors are not the ones who save the longest but the ones who know how to use lending flexibility to move forward. The 20% rule no longer determines readiness; strategy does.

How LVR Affects Your Borrowing Power and Costs

The size of your deposit influences more than when you can buy. It shapes how much you can borrow, how much you pay in lender’s mortgage insurance (LMI), and even the rate you are offered.

Understanding how LVR affects these outcomes can mean the difference between waiting years and starting now.

LVR represents the portion of a property financed through a loan compared to its total value. A lower LVR means you are borrowing less, which reduces the lender’s risk.

A higher LVR allows you to buy sooner, but usually attracts LMI costs and a small rate premium as compensation for the increased exposure.

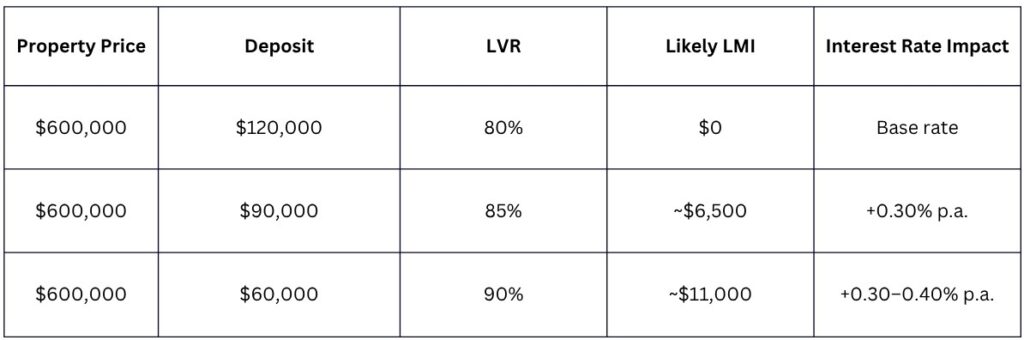

Consider a $600,000 investment property. An 80% LVR requires a $120,000 deposit and avoids LMI altogether. At 85% LVR, your deposit drops to $90,000, but you’ll pay roughly $6,500 in LMI and an additional 0.30% per year in interest.

Pushing to a 90% LVR means a $60,000 deposit, about $11,000 in LMI, and a rate increase between 0.30% and 0.40%, as shown in Westpac’s 2025 interest-only schedule.

LMI protects the lender, but it also makes smaller deposits possible. The cost can be paid upfront or added to your loan, depending on the lender’s policy.

ASIC provides an online estimator that helps investors calculate likely LMI fees for different borrowing scenarios through its MoneySmart LMI Calculator.

Four Smart Ways to Buy With Less Than 20% Deposit

Saving a 20% deposit may seem like the responsible thing to do, yet it often delays real progress while property prices continue to rise.

Many Australians are learning that smart structure and timing matter more than waiting for a perfect number. The key is to use what you already have to move forward with confidence.

1. Use Existing Equity

Equity is one of the most effective ways to buy an investment property sooner. It’s the portion of your home you already own, and lenders allow you to use it as a deposit for another property.

Example:

If your home is valued at $900,000 and your loan balance is $600,000:

- 80% of your property’s value = $720,000

- Subtract the $600,000 loan

- Usable equity = $120,000

That $120,000 can fund your next purchase without needing to sell or save for years. Kev Tran Group has helped many investors grow their portfolios this way, using one property to build momentum and long-term wealth.

2. Guarantor Loans or Family Security Guarantee

A guarantor loan lets a family member use a portion of their property’s equity to support your purchase. This method can reduce or remove the need for LMI and, in some cases, cover up to the entire purchase price. It can:

- Fund up to 100% of the property’s value

- Lower upfront costs

- Enable faster market entry

This type of lending gives families the opportunity to help each other build wealth without transferring cash.

Legal and financial guidance ensures everyone understands their commitments before signing any agreement.

3. Professional (LMI-Free) Loans

Some lenders offer LMI-free investment loans to certain professionals, such as doctors, dentists, and lawyers.

These occupations are considered low-risk because of their stable income and financial discipline. Such programs typically:

- Allow borrowing up to 95% LVR

- Remove LMI costs that can exceed $10,000

- Free up funds for other property expenses or improvements

This form of lending rewards consistent income and financial strength rather than a fixed savings target.

4. Partner or Joint Venture

Combining resources with another investor can unlock access to stronger assets and higher borrowing capacity.

A well-structured partnership can share both risk and reward while accelerating portfolio growth. The agreement should include:

- Defined ownership percentages

- Clear financial responsibilities

- Planned exit strategies

Independent legal advice protects both parties and ensures the arrangement supports their long-term goals. We have seen collaborative investors achieve stronger results through shared strategy and financial alignment.

When Paying the Full 20% Still Makes Sense

Using a smaller deposit can help investors start sooner, but contributing the full 20% remains a powerful move when the goal is long-term strength.

Paying more up front can improve cash flow, lower costs, and create flexibility that benefits every future decision.

Key advantages of a 20% deposit:

- No Lender’s Mortgage Insurance (LMI): Avoiding LMI can save more than $10,000 on a typical loan, improving both upfront and long-term affordability.

- Lower interest rates: Lenders often offer sharper pricing for loans under 80% LVR, which reduces total interest over the life of the loan.

- Smaller loan balance: A lower principal means lower repayments and faster progress toward positive cash flow.

- Easier refinancing: With an LVR under 80%, lenders are more willing to refinance, release equity, or offer new facilities for future purchases.

- Higher resilience: A stronger equity position protects against value drops or market changes and improves overall borrowing power.

For example, on a $600,000 property, borrowing 80% instead of 90% can cut repayments by roughly $400 a month and save over $80,000 in total interest across 30 years.

The compounding effect of smaller repayments and lower rates strengthens your financial position over time.

Our analysis shows that investors who use a full 20% deposit often gain more freedom as their portfolios expand.

They experience smoother refinancing, reduced pressure during interest rate cycles, and stronger equity growth that compounds through every property they own.

For investors with the resources to do it, paying the full deposit remains one of the most effective ways to build wealth with control and stability.

Example of Buying With a 10% Deposit

A couple in Queensland decided to stop waiting for a larger deposit and invest with what they already had. They purchased a $550,000 home in Toowoomba using a 10% deposit of $55,000. The remaining $495,000 was financed under a 90% loan-to-value ratio (LVR).

Because their deposit was below 20%, the lender’s mortgage insurance (LMI) of around $9,000 was added to the loan. Their interest rate carried a small premium, increasing annual costs by roughly $2,400.

Even with this adjustment, the property’s 5.2% rental yield, based on CoreLogic’s 2025 regional data, helped cover most of the repayments and provided steady cash flow.

Within two years, the property’s value rose from $550,000 to $610,000, creating $60,000 in equity growth. The couple turned a modest deposit into real progress, proving that entry timing often matters more than waiting for a perfect number.

Our experience with similar investors shows that smaller deposits, used strategically, can deliver strong returns when combined with market research and sound structure.

This example shows how a 10% deposit can build momentum faster than waiting for a larger one. With the right planning and data, smaller beginnings can lead to meaningful long-term results.

Frequently Asked Questions

1. Can investors still buy with a 5% deposit in 2025?

Yes. Some lenders allow 5% deposits through guarantor loans or special occupation programs for professionals in stable, high-income industries.

2. When does lender’s mortgage insurance (LMI) apply?

LMI applies when borrowing more than 80% of a property’s value. It protects the lender, not the borrower, and usually costs between $6,000 and $12,000, depending on the loan size.

3. How common is high-LVR lending now?

Very common. APRA’s June 2025 data shows that 30.4% of all new loans had an LVR above 80%, proving many Australians are investing with smaller deposits.

4. What’s the biggest trade-off under a 20% deposit?

Higher long-term costs. Borrowers pay LMI and a small rate premium of around 0.30%, which increases total repayments over time.

5. Does a smaller deposit reduce borrowing power?

Yes. Lenders often apply tighter scrutiny and may cap how much you can borrow because higher-LVR loans carry more risk.

6. Can LMI ever be avoided with less than a 20% deposit?

In some cases. Certain professionals or guarantor-backed borrowers can qualify for LMI-free loans even with deposits as low as 5% to 10%, depending on the lender’s criteria.

Why Clarity Creates Wealth Faster Than Saving Ever Will

The 20% rule has held more Australians back from building wealth than any market downturn ever has.

It convinces capable investors to keep saving, keep waiting, and keep missing the very opportunities that could change their future. The market never waits for anyone, and hesitation has become the costliest choice of all.

Investors who build real wealth understand how to use the system, not fear it. They use equity, guarantees, and strategic lending to move with purpose, while others hold back.

Each year of waiting is another year of lost rental income, missed growth, and higher prices to chase later.

Playing it safe is no longer safe. The difference between those who succeed and those who stall is simple: one takes action while the other waits for permission.

If you’re serious about building wealth, stop watching from the sidelines. Book your clarity call with Kev Tran Group now and see exactly how to turn your income, equity, or savings into a high-performing property portfolio. The longer you wait, the further you fall behind.